Īdditional child tax credit from Schedule 8812ĭo you want to allow another person to discuss this return with the IRS? See This is your total taxĢ022 estimated tax payments and amount applied from 2021 return. Other taxes, including self-employment tax, from Schedule 2, line 21Īdd lines 22 and 23. Ĭhild tax credit or credit for other dependents from Schedule 8812.

Check if any from Form(s): 1Īdd lines 16 and 17. This is the amount you owe.įor details on how to pay, go to or see instructions. Īmount of line 34 you want applied to your 2023 estimated tax. This is the amount you overpaidĪmount of line 34 you want refunded to you. If line 33 is more than line 24, subtract line 24 from line 33. These are your total other payments and refundable creditsĪdd lines 25d, 26, and 32. (4) Check the box if qualifies for (see instructions):Īmerican opportunity credit from Form 8863, line 8. This is your taxable incomeįor Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Qualified business income deduction from Form 8995 or Form 8995-A. Standard deduction or itemized deductions (from Schedule A) Īdjustments to income from Schedule 1, line 26 If you elect to use the lump-sum election method, check here (see instructions)Ĭapital gain or (loss). Tip income not reported on line 1a (see instructions). Household employee wages not reported on Form(s) W-2. Total amount from Form(s) W-2, box 1 (see instructions).

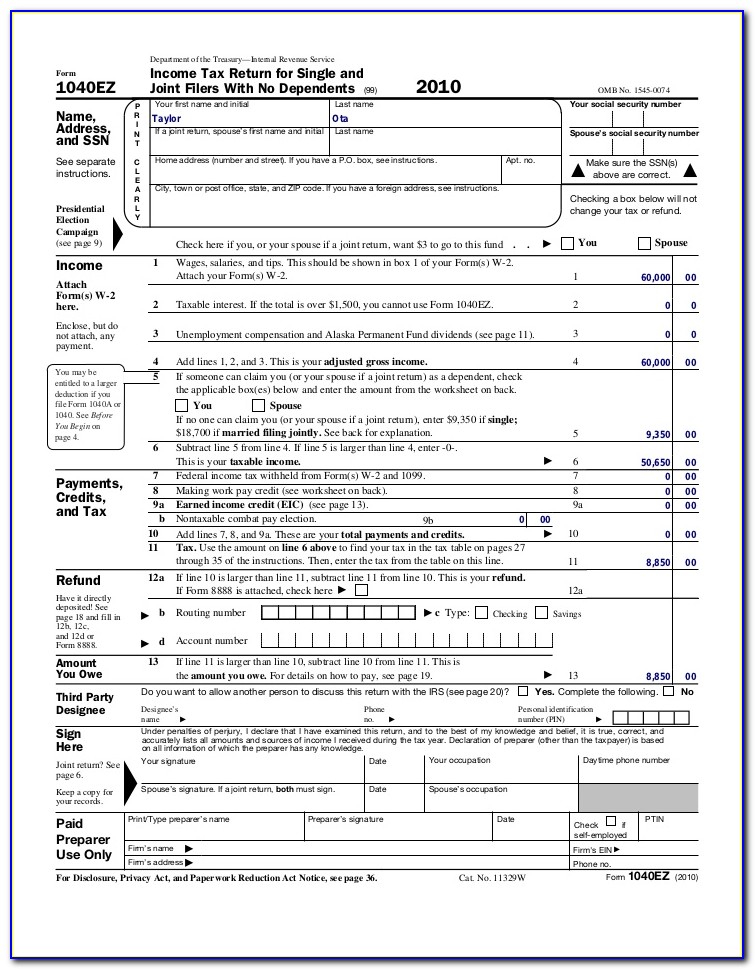

Nontaxable combat pay election (see instructions). Taxable dependent care benefits from Form 2441, line 26Įmployer-provided adoption benefits from Form 8839, line 29 Medicaid waiver payments not reported on Form(s) W-2 (see instructions). Spouse itemizes on a separate return or you were a dual-status alienĪt any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services) or (b) sell,Įxchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) If you have a foreign address, also complete spaces below. box, see instructions.Ĭity, town, or post office. If joint return, spouse’s first name and middle initial Person is a child but not your dependent: If you checked the HOH or QSS box, enter the child’s name if the qualifying If you checked the MFS box, enter the name of your spouse. IRS Use Only-Do not write or staple in this space. Individual Income Tax Return 2022ĭepartment of the Treasury-Internal Revenue Service Income Tax Return for Single and Joint Filers With No Dependentsġ040 U.S.

0 kommentar(er)

0 kommentar(er)